Fascination About Medicare Specialist

Table of ContentsThe Basic Principles Of Medicare advantage How Medicare supplements can Save You Time, Stress, and Money.Examine This Report about Medicare supplements

Medicare Advantage Specialists (MAS Insurance Coverage) has been helping independent insurance agents in their careers for over 15 years - i loved this. As one of the largest Senior Market insurance coverage agencies in the country, we have the understanding, experience and training possibilities available to aid you begin, as well as the top service providers with the most affordable insurance products and critical marketing systems in the nation.

Medicare Benefit Strategies are a choice to initial Medicare. It consists of Part A (Medical Facility), Part B (Physician Tests and also various other solutions) in Medicare and also some plans include Part D (click to find out more).A+B+D=CAlso called Part C, Benefit Program provide you additional benefits that are not consisted of in initial Medicare such as Vision, Dental as well as Hearing Service Plans.

The Buzz on Medicare supplements

At Elder Health Insurance Plan Specialists, we will aid you when selecting the correct medication prepare for your present drugs. Medicare supplements. We use a no expense evaluation as to which business has your existing drugs in their formularies as well as offer the most affordable price each year. We will additionally assist you Going Here to see if you qualify for LIS (Low Revenue Subsidy) or legendary to assist with premiums for your drug plans and also price of drugs if you qualify.

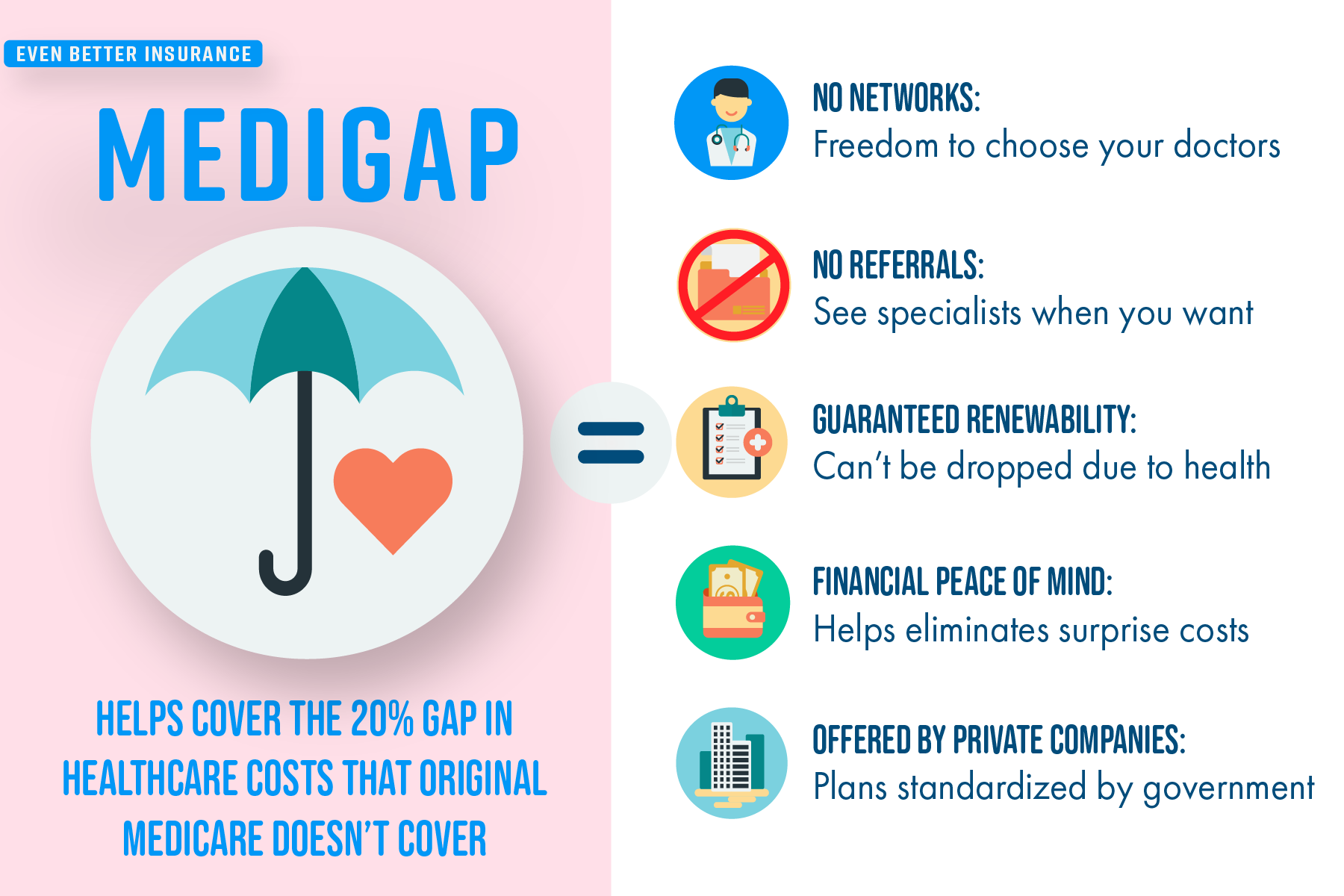

They pay a few of the healthcare costs that original Medicare does not cover (co-pays and deductibles that you are responsible to pay.)It is your duty as a customer to see that has the most affordable premiums as additional strategy cover the very same solutions from each business. Their prices are by claims submitted so the premiums vary.

Not all physicians approve Medicare for the clients they see, a progressively typical event. This can leave you with higher out-of-pocket expenses than you expected and a difficult decision if you actually like that medical professional. So what takes place when you authorize up for Medicare just to discover it's a no-go at your favored physician? Fortunately, you have some alternatives.

While a space always existed, several doctors really feel that Medicare compensations haven't maintained speed with inflation in the previous a number of years, particularly the rising costs of running a clinical method (Medicare Asdvisor). At the same time, the regulations as well as regulations maintain obtaining much more burdensome, as do fines for not abiding by them.

The 5-Minute Rule for Medicare advantage

If your doctor is non-participating or has actually decided out of Medicare, here are 5 options. 1. Stay Put and Pay the Difference If your doctor is what's called a non-participating company, it indicates they haven't authorized an agreement to accept assignment for all Medicare-covered solutions, however can still pick to approve task for private patients.

These non-participating service providers can charge up to 15% over the official Medicare reimbursement quantity. If you select to stick with your non-participating medical professional, you'll need to pay the difference between the costs and the Medicare reimbursement. And also, you may have to divulge the whole amount of the bill during your office browse through.

2. Ask for a Discount If your medical professional is what's called an opt-out company, they might still agree to see Medicare clients yet will expect to be paid their complete feenot the smaller Medicare repayment quantity. These docs approve no Medicare compensation, and Medicare doesn't pay for any section of the expenses you obtain from them (Medicare Specialist).

Opt-out medical professionals are required to disclose the cost of all their services to you upfront. These medical professionals will certainly additionally have you sign an exclusive contract saying you agree to the opt-out plan.